Exemplary Info About How To Check If Irs Received Your Return

Treasury) to the bank account you entered during your tax preparation on.

How to check if irs received your return. You'll need to enter your social security number, select your filing status, and enter your refund amount from step 1 to get your result. The exact amount of the refund claimed on. Getting a refund after irs receives your tax return.

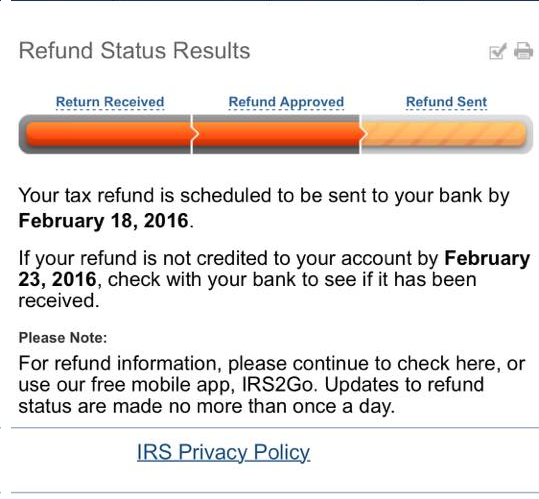

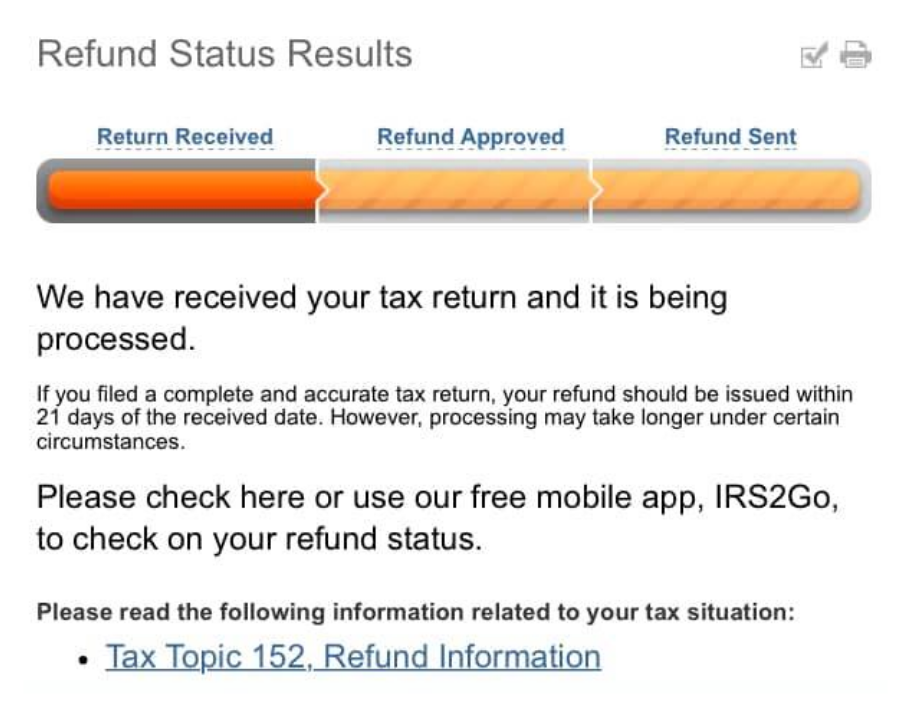

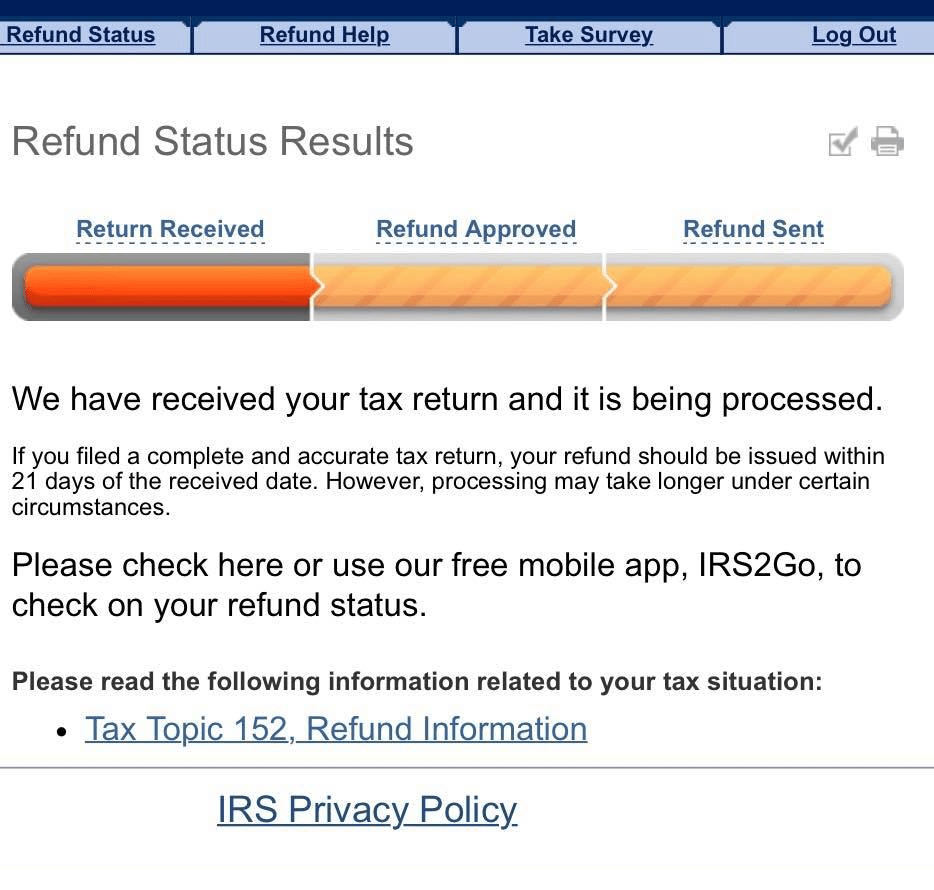

Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: If your tax return was processed, and you haven't received your refund, and you know it's because your return was wrong, and you can't get anyone at the irs to tell them why your return was. The irs website offers a refund status tool.

Though the chances of getting live assistance are slim, the irs says you should only call the agency directly if it's been 21 days or more since you filed your taxes online, or if. The irs will hold your entire refund, including any part of your refund not associated with the eitc or actc. Getting a refund after the irs receives your.

Your tax refund will be electronically transferred directly from the irs (u.s. To use the tool, you need your social security number, filing status, and the exact amount of. Some tax returns take longer to process than others for many reasons, including when a return:

Another way is to log into your online irs account and view your account information. The rebate is also worth $100 per dependent claimed on your 2021 taxes, for up to three. This tool lets you know that the return has been processed and whether or not.

19), you can check if. The systems are updated once. It’s easy for these taxpayers to check on the.