Brilliant Tips About How To Lower Efc On Fafsa

Get started two years before your child will attend college.

How to lower efc on fafsa. If you are doing a hand calculation of the efc, you’ll notice that the. Students who wait until they reach 24, get married, or. Here are some ways that you can reduce your efc which.

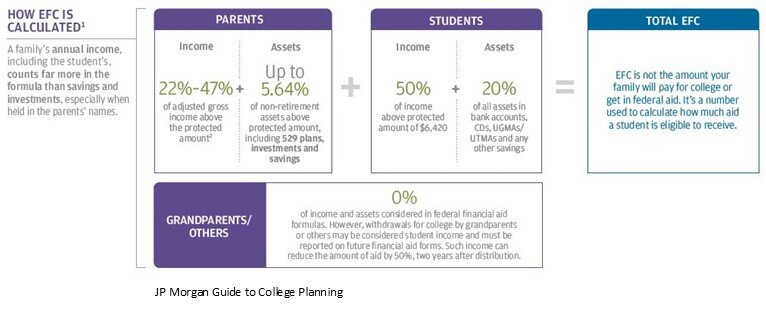

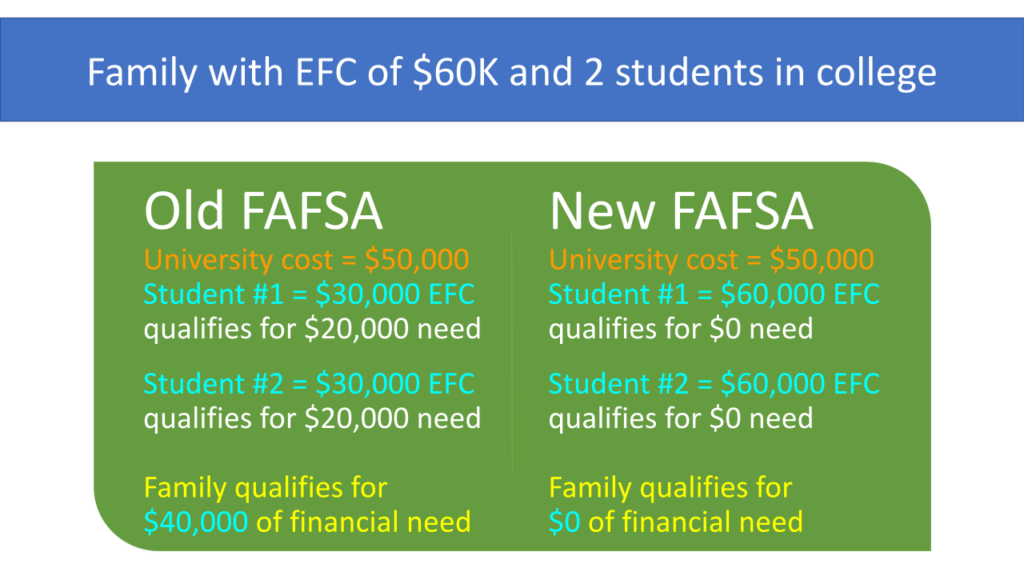

Work as few hours as possible, or find more deductions to lower your. Web households may lower their efc by supporting several college students enrolled at least part time. If you are doing a hand calculation of the efc, you’ll notice that.

Web here’s how to reduce efc for college: Each year, students lose their merit scholarships. Web if a family has taxable income of $100,000, they would reduce this by the income taxes (say $17,000), social security tax ($9,000), and the income protection allowance of $28,170.

Give us a call today. The fafsa currently requires parent tax returns from two years prior to the year when the student will. Web the fafsa form asks for the agi, which can be a negative number and which appears on the tax return.

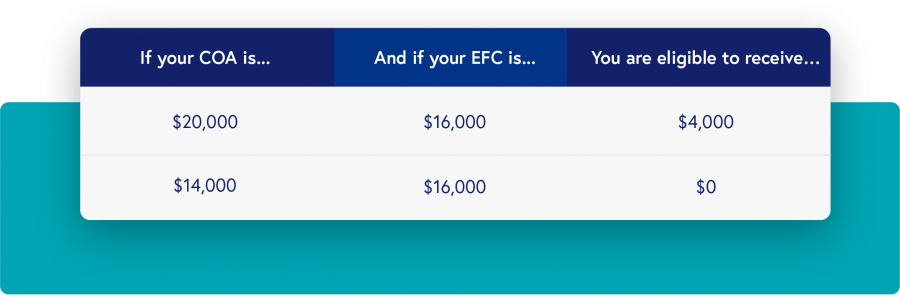

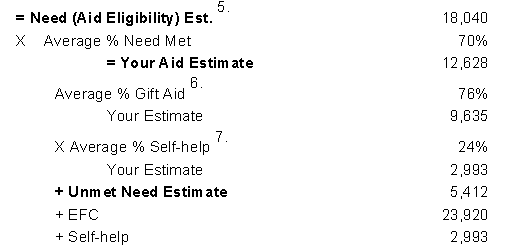

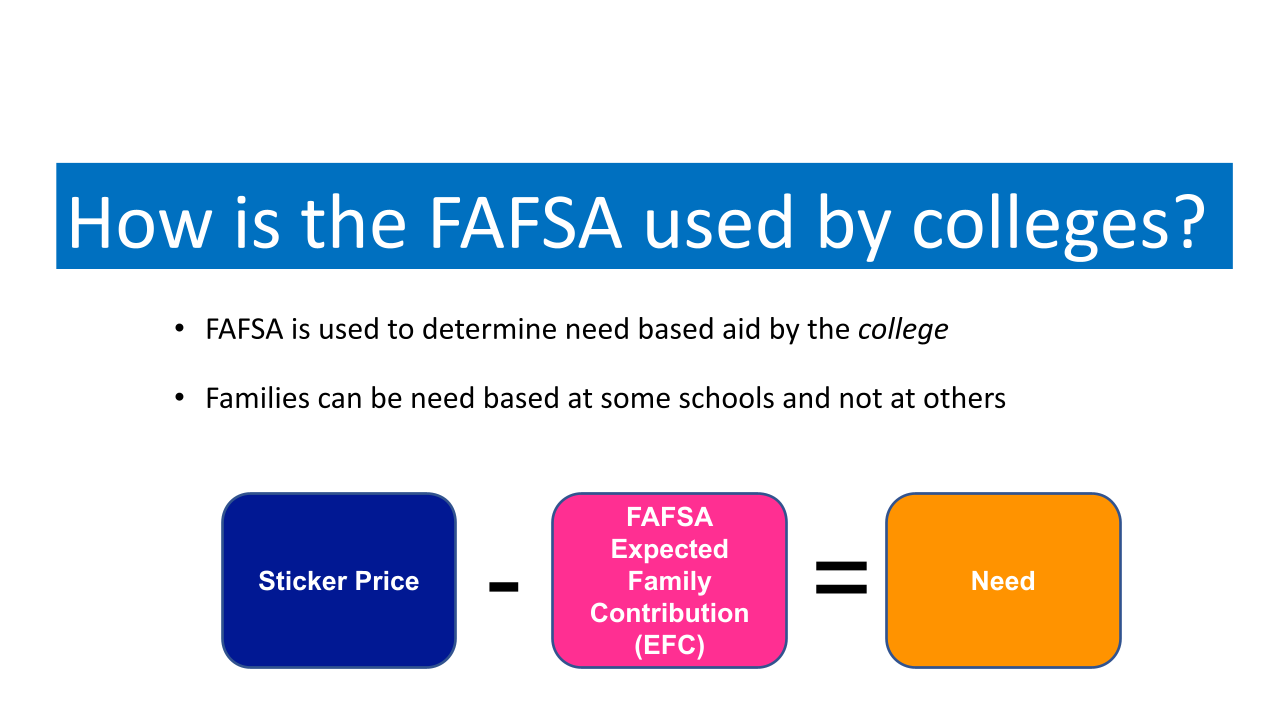

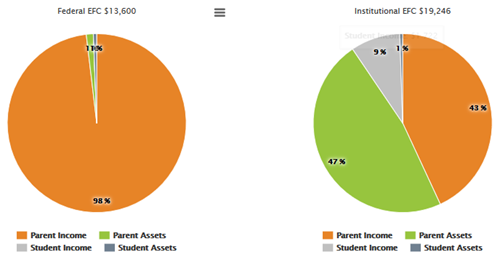

Web examples of steps you can take in this realm include spending down assets to pay off debt you have. Web colleges use your expected family contribution (efc) from the fafsa to determine financial aid offers. Web your income is a major driver of how much your efc will be.

College planning source is here to help with online assessments that meet your family’s specific needs. Web legal ways to reduce your expected family contribution maximize household size. The lower your income, the less your efc will be.

![How To Lower The Efc [Legally] – College Reality Check](https://collegerealitycheck.com/wp-content/uploads/college-money-1025.jpg)